Korea Music Copyright Association Releases Streaming Revenue Report: Platforms Receive 83%, Creators Only 10.5%

Korean Music Copyright Association Reveals Striking Disparities in Streaming Revenue Distribution

The Korean Music Copyright Association (KMCA) has teamed up with one of the nation’s leading accounting firms, EY Han Young, to delve into the complexities of the domestic and international music streaming market. Their recently published report sheds light on the concerning revenue distribution structure for local music creators in South Korea.

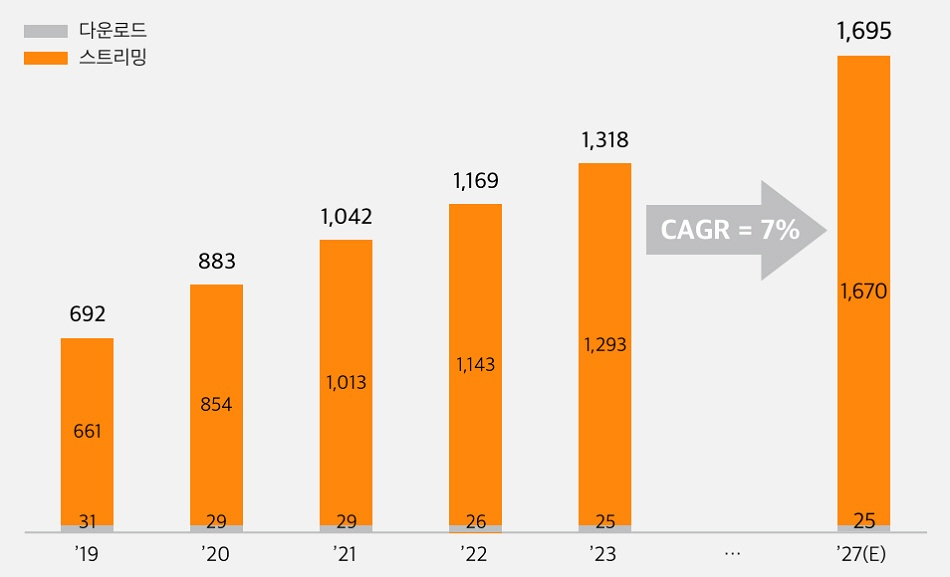

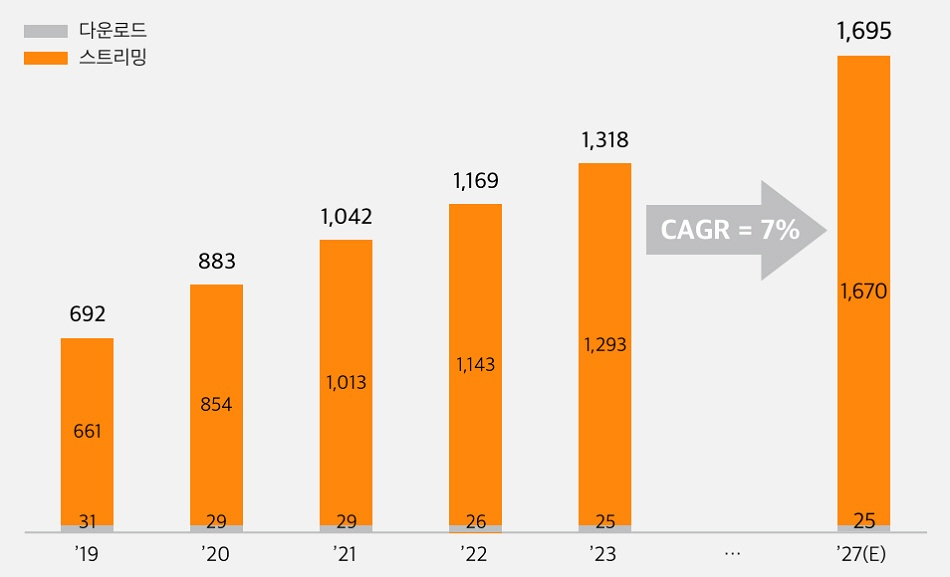

According to the findings, the domestic digital music market has skyrocketed from approximately $700 million in 2019 to a staggering $1.32 billion in 2023—almost doubling in size. This impressive growth has positioned South Korea ahead of Japan, heralded as Asia’s premier music market. Notably, the streaming sector alone has experienced nearly 100% growth over the last five years, driving the overall expansion of the digital music industry.

Source: Statista, MarketLine, Mordor Intelligence, EY Analysis

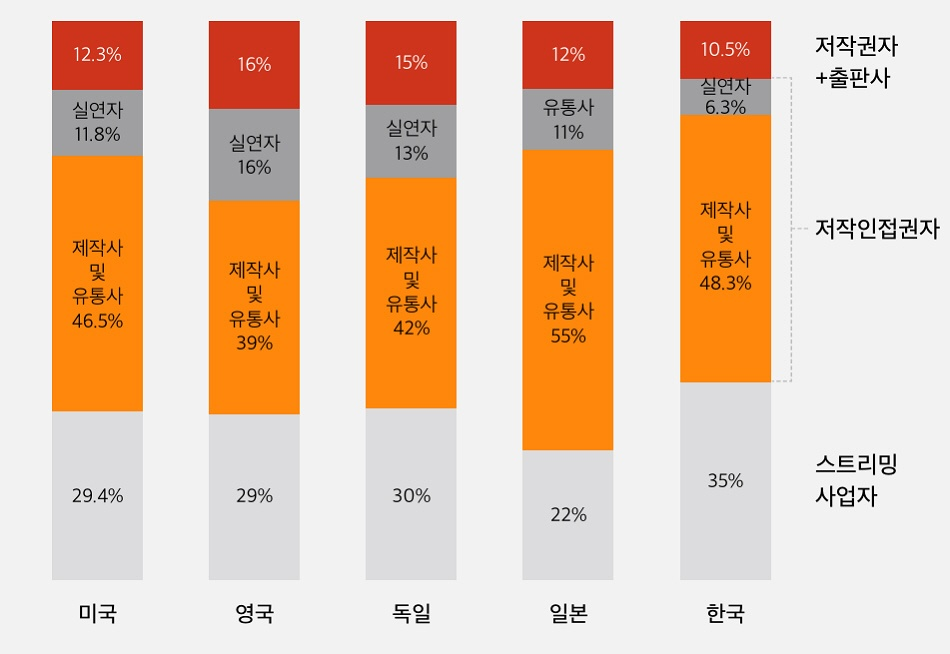

Despite this robust market growth, the share of revenue going to creators remains strikingly low. While creators in the U.S. earn 12.3% of streaming revenue, in the UK it’s 16%, and in Germany 15%. South Korea, however, lags behind at just 10.5%. This figure falls short by 1.8% to 5.5% compared to other major music markets.

The issue of low revenue distribution is even more pronounced when we analyze the overall income structures on streaming platforms. For instance, in the U.S., platform operators claim about 29.4% of revenue, while the UK and Germany sit around 29% and 30%, respectively. South Korea, on the other hand, tops the list at 35%. This results in creators receiving a disproportionate share of the revenue generated by their work.

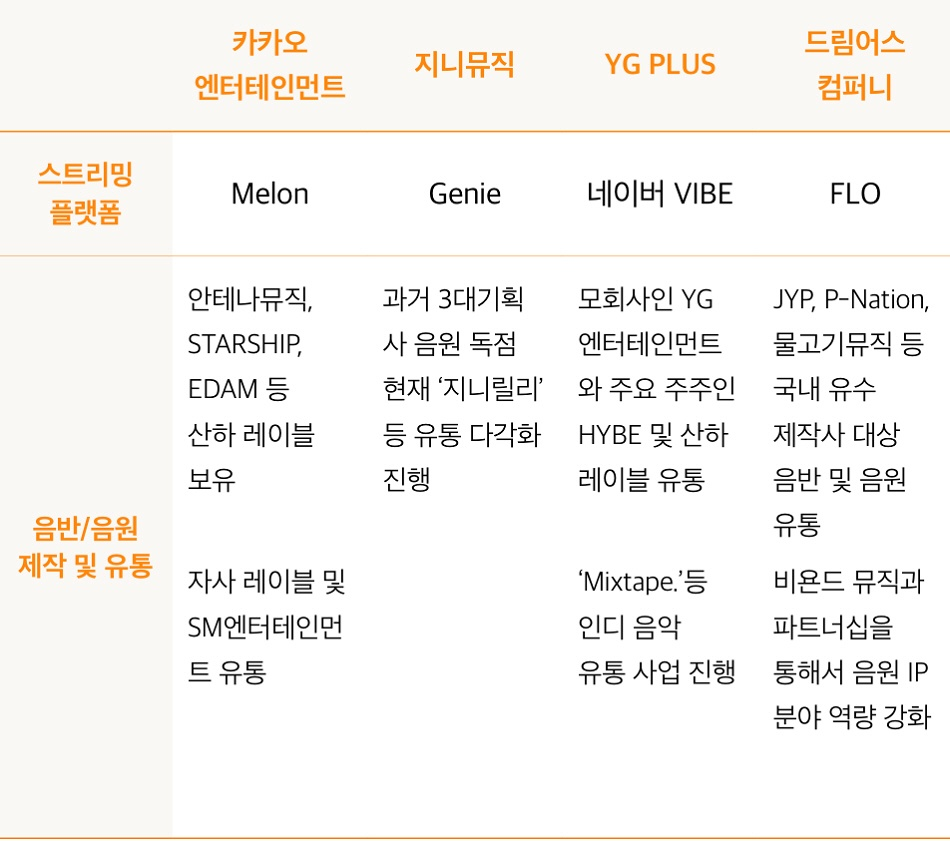

Many of South Korea’s leading streaming platforms operate under a vertical integration model that encompasses production, distribution, and sales, allowing them to capture over 83% of streaming revenues. This makes the mere 10.5% share for creators seem especially egregious in comparison.

Source: EY Analysis

Alarmingly, despite these challenges, government policies seem to prioritize alleviating the burden on platform operators rather than protecting creators. A prime example is the “Music Copyright Fee Cooperative Measure” implemented in 2022. This initiative allows for in-app purchase fees from app market giants like Google and Apple to be excluded from the revenue calculations for copyright royalties. Previously, royalties were based on total revenue, but the recent changes mean that these fees are now deducted before calculating what creators earn.

This adjustment has prompted criticism as it places further financial strain on creators, who already receive only a fraction of streaming revenues. Critics argue that this cooperative measure sacrifices the interests of artists for the benefit of platform operators.

Source: EY Analysis

Moreover, the measure has recently been extended to 2024, while keeping the royalty rate static. This has effectively decreased the actual earnings for copyright holders as the applicable revenue base continues to shrink.

In stark contrast, countries abroad are adopting more supportive measures for creators. In the U.S., for example, streaming royalty rates are set to rise to 15.35% by 2027, bolstered by legislative changes since 2018 that focus on faster payments and penalties for delays in royalty disbursement.

A KMCA spokesperson commented, “As the digital music market continues to expand, it’s crucial to uphold the rights of creators. Protecting their legitimate interests is essential for fostering a sustainable ecosystem.” The association vows to actively pursue improved policies and increased royalty rates to better serve the interests of copyright holders in the future.