K-POP NEWS

- KPOP NEWS

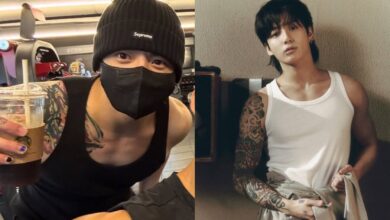

Jungkook of BTS Unveils New Tattoos

A new photo of Jungkook has sparked a lot of excitement among BTS fans recently. The image has been shared…

Read More - KPOP NEWS

Stray Kids Break Record for K-Pop Concert Attendance in France with 120,000 Fans

Stray Kids pulled off a major milestone by selling out two nights at Paris’s Stade de France, a venue that…

Read More - KPOP NEWS

Stray Kids Announce Titles of 11 Tracks from Their Upcoming Fourth Album “KARMA”

Stray Kids is gearing up to drop their fourth studio album, KARMA, and fans are getting a closer look at…

Read More - KPOP NEWS

Moon Hee Jun Shares Heartbreaking Family Story on ‘Table for 4’ About Father Leaving and Missing Mother’s Funeral

Moon Hee Jun, known as a former member of the iconic first-generation K-pop group H.O.T, has shared more about the…

Read More - KPOP NEWS

National Tax Service Initiates Special Probe into HYBE Over Market Manipulation Claims

HYBE, the powerhouse behind some of K-pop’s biggest acts, is now dealing with its toughest challenge since it first launched.…

Read More - KPOP NEWS

BLACKPINK Debuts Live Performance of New Single “JUMP” at Goyang Concert

BLACKPINK’s latest single “JUMP” is making waves worldwide, and the group didn’t stop there. On July 29th, they dropped their…

Read More

K-DRAMA NEWS

RECENT POLLS

-

Best Kpop Vocalist 2025

Best Kpop Vocalist 2025 – Vocal ability has always been a defining…

-

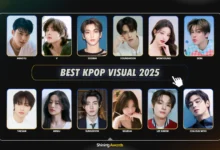

Best Kpop Visual 2025

Best Kpop Visual 2025 – Every year, K-pop fans eagerly select the…

-

Best Kpop Leader 2025

Best Kpop Leader 2025 – The title of Best Kpop Leader 2025…

-

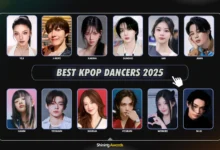

Best Kpop Dancers 2025

Best Kpop Dancers 2025 – In K-pop, dance has always played a…

-

Best Kpop Rappers 2025

Best Kpop Rappers 2025 – Rap has become a key element in…

-

Most Handsome Korean Actors 2025

Most Handsome Korean Actors 2025 – The Most Handsome Korean Actors 2025…